As we approach digitalization, the banking industry has become more dynamic than ever before. They are evolving their banking solutions rapidly and trying to adapt to digitalization so that they can connect with more customers in innovative ways. This has made them adopt digital marketing for banks so that they can stay ahead of the game in financial marketing.

According to a Fujitsu Global Survey, 89% of all finance companies are working towards a digital revolution. As financial institutions struggle with dynamic market conditions, they need to create a strong online presence in order to keep up with the competition. This will help them foster customer acquisition and retain their loyalty.

If the banks want to sustain themselves in this competitive financial industry, they need to give up traditional marketing strategies and shift to digital strategies.

Here is a roadmap of several bank marketing strategies that should be considered for survival and expanding the growth of their operations. But before that, let’s discuss why marketing is important for the banks!

What is Digital Marketing for Banks?

By digital marketing for banks, we refer to the process of using different marketing tactics like email marketing, search engine marketing, and social media marketing in building and increasing their brand awareness. This helps the banking sector drive more customer acquisition and connecting with more banking prospects.

The development of digital technology has transformed various sectors and the banking sector is not an exception.

In order to stay up with the ever-evolving market, the banking sector has leveraged digital marketing techniques. In fact, its impact has also been seen in APAC (Asian Pacific).

Leveraging these digital marketing techniques helps them connect with their target consumers easily and engage with them on a bigger scale. So, in order to keep up with the competition and maintain a solid online presence, banks use digital marketing.

Why Digital Marketing is Important for the Banking Industry

In this dynamic banking industry, digital marketing has become crucial for banks to navigate smoothly across ever-evolving online platforms. This has also fostered the engagement of customers and sustained more competitiveness in this digital landscape. These digital marketing strategies have also evolved the expectations of customers from the marketing agencies.

Here are some other reasons that suggest why digital marketing is significant for the banking industry.

- Caters to the Digital Customer Base

The rapid increase in digitalization has made customers digitally connected more than ever before. This has led to their expectation of a more seamless and convenient banking experience.

Keeping these tech-savvy customers in mind, banks should focus on making their banking services completely digital. This will provide the diverse customer base an easy access to all the digital banking services and it will also help banks in finding their target audience digitally.

- Progress Through the Competitive Landscape

A cut-throat competition has been intensified among financial service providers with the emergence of several digital-only banks and fintech companies. This has also put some challenges before traditional banks which they need to overcome.

If traditional banks want to stand out in this competitive and crowded marketplace, they need to maintain a strong online presence. Not just that, in order to retain the existing clients and attract the new ones, they also need to present their service offerings and values strategically.

- Builds Trust and Maintains Reputation

Digital marketing for banks must establish trust among the customers so that more customers can rely on your banking services. In fact, they must uphold a reputation for being more customer-centric, secure, and reliable.

As per the reports, it has been seen that in Southeast Asia, 95% of the customers who are quite satisfied with their banking apps experience are likely to stick to the same bank.

Bank marketing also helps banks in developing a positive brand image with community engagement and effective communication. This even helps them foster enhanced customer loyalty.

- Ensures Ethical Marketing and Regulatory Compliance

Some recent incidents in the risky crypto businesses have put the entire finance industry in jeopardy. These incidents have also highlighted the importance of banks in maintaining ethical marketing practices. The banks must also be careful enough to ensure compliance with the regulatory standards.

Bank marketing also includes honest and transparent communication with their clients while maintaining the privacy of the customers.

Top 8 Digital Marketing Strategies that can Boost Your Online Banking Experience

With the emerging technologies, it becomes essential for the banks to harness the power of comprehensive digital marketing strategy to achieve success in this digital age.

Take a look at some of the most effective digital marketing strategies that financial marketers often implement to blaze new trails in the world of bank marketing.

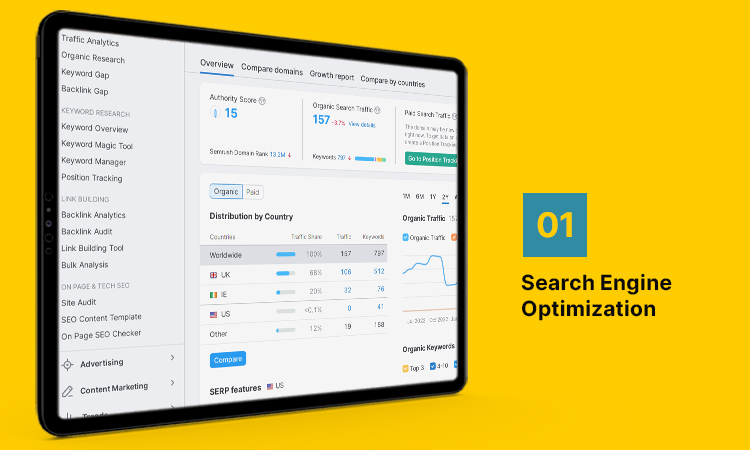

- Search Engine Optimization (SEO) for Bringing in More Website Traffic

In a bank’s digital marketing strategy, search engine optimization plays a vital role. It increases your banking website’s exposure in organic search engine results and boosts your website’s ranking.

Search Engine Optimization also helps your bank’s website establish itself as an authority in the financial landscape. The two most important SEO aspects that are responsible for an increase in your bank website’s traffic and lead generation are – local SEO and content marketing.

- Local SEO Focusing on Specialized Services and Branch Locations

Banks often target customers from local areas to gain more visibility and dominance in the local areas. So, in case you want to attract more customers to your local bank, then your banking website should be optimized for ranking higher in the local search results.

Check out these few things while creating local SEO marketing campaigns for banks:

- Incorporation of Local Keywords: While doing local SEO, ensure to incorporate local keywords into your website content. You can even include in your content the names of the cities or neighbourhood areas where your bank branches are located.

- Google Business Profile Optimization: This is prominently one of the most important optimizations that you need to make. You need to make sure that the Google Business listing of your bank is completely and accurately mentioned in your profile. Also, ensure that the branch locations, service offerings and hours of operation are updated in the profile.

- Link Building Locally: Establishing links with local banks and services is significantly important for improving the search rankings of your local bank.

- Content Marketing for Developing Relevant Financial Contents for Target Audience

Content marketing involves the creation of relevant and valuable educational content related to financial institutions for your target audience. This involves:

- Keyword Optimization: Implementing relevant keywords throughout the bank website content will help in improving your website’s visibility in the search engine results pages.

- Develop Video Contents: You can also develop some financial advice based video content or tutorials. These are beneficial from the SEO perspective as well as helpful in engaging more users to your site.

- Write Informative Articles and Blogs: If you want to position your bank as a knowledge leader in the industry, then you can educate your visitors with some finance-related advice or trends. You can create blogs or articles related to financial education in order to inform and add value to your web visitors.

This effective digital marketing strategy will improve the online visibility of your banks. Moreover, it will also make it simpler for potential customers to look out for your banking services.

- Social Media Marketing Strategies for Banks

Social media platforms act as goldmines for the banks to engage with their customers and actively promote their banking products & services. By sharing some informative and valuable posts related to the banking sector on popular social media sites like Instagram, LinkedIn, and Twitter, increases brand recognition.

Thus, social media marketing plays a major role in the banking sector as it increases trust and promotes customer engagement. You can cater to the financial literacy needs of young users by sharing some informative content on these platforms that will simplify their complex financial concepts.

- Instagram for Promoting Financial Products

By utilizing interactive features of Instagram like Q&A sessions, stories, and polls, you can directly engage with the audience and gather real-time feedback. You can even make use of high-quality videos and images to share your customer experiences and tell stories about your banking products.

In case you want to add more credibility to your bank marketing strategy, then you can collaborate with popular social media influencers. They will also encourage you to reach a wider audience.

- LinkedIn for Attracting Corporate Clients

As a bank, if you want to show your finance solutions to corporates, you can do so by sharing posts that address the financial requirements of businesses. You can also host some online banking events or webinars on digital channels like LinkedIn that solely focus on financial topics related to business.

Moreover, these social media platforms also allow you to network with other businesses and take active participation in professional discussions. This will increase your bank’s social media presence and help in building a professional image to attract more corporate clients.

- Paid Advertising Campaigns to Increase Brand Recognition

Running paid advertising campaigns is one of the most targeted digital marketing trends that are being used nowadays for reaching potential customers. Though paid search marketing strategy for banks involves direct costs, it helps you target specific demographic cohorts who are likely interested in availing banking services. In fact, traffic that comes through paid ads is 50% more likely to convert.

- Develop Google Ads Campaigns to Target Customers Looking for Financial Services

Creating relevant Google ad campaigns can help you find customers who are looking for financial services. This also allows banks to feature their advertisements in the Google search results and other websites which will significantly increase brand awareness.

Paid Ads is a powerful digital marketing strategy. You can execute it in 3 steps that we are enumerating below;

- Keyword Targeting & Bidding: Targeting and bidding on keywords enables you to set a budget for your PPC campaign.Your digging decides how and where your a would appear on the Google search results.

- Crafting Compelling Ad Copy: Create engaging digital advertising ads for your audience that are relevant to your bank with a crystal-clear call to action. Ensure to customize your ad copies in a way that it perfectly aligns with the search intent of the keywords. Make sure to include a CTA in the Ad copy for better click through rate.

- Link Ad to relevant Landing Page: When a prospect clicks on the ad, it should direct them to the relevant landing page and not the main page of the website. Linking with a specific service page boosts the conversion rate as prospective clients find relevant information on what they were searching for in the first place.

- Launch Social Media Ads to Reach a Broader Audience

Banks might utilize a plethora of social media marketing channels available to target users depending on their interests, behaviour, and demographics. You can try out any of these methods to reach your target audience:

- Segmentation of Audiences: Focus on creating different ads involving different segments of audiences like businesses, young audiences, and teenagers. You should also tailor the social media messages accordingly to target specific groups of audiences.

- Create Engaging Formats: Showcase different aspects of your banking services by creating engaging formats or a mix of formats like video, image, and carousel ads. This will attract different types of audiences and engage them.

- Develop Retargeting Campaigns: Another way to convert your web visitors to your customers is by creating and implementing retargeting social media campaigns. This will help retarget users who have previously interacted online with your bank or have visited your bank website.

Thus, these pay-per-click ad campaigns can be strategically used to reach a widespread audience.

- Email Marketing Strategies Based on Customer Behavior

One of the most affordable digital marketing for banks strategy that helps banks in reaching their clients in a more focused way is through email marketing. By sending targeted/personalized and promotional emails to their clients, banks might advertise their products and services, keep their customers engaged and informed and increase their customer retention.

- Customized Email Campaigns for Sharing Financial Advice and Personalized Offers

In order to deliver a tailored experience to their customers, banks often make use of this digital marketing strategy. They analyze customer data and based on their consumer behavior or any significant action taken by them, they segment their audience.

Accordingly, they divide their email list into different segments and tailor their messages to make them more appealing and relevant. They also provide them with customized offers like any investment advice specific loan rates, etc.

Moreover, their email campaigns are also customized on the basis of their recent interactions with your services. Like, a follow-up mail after they have placed any inquiry or made any significant transactions.

- Automated Email Campaigns for Some Specific Actions

Through automated email campaigns, the bank tries to provide relevant information to their customers in order to trigger specific actions from them. Some examples include transactional emails, welcoming emails, and lifecycle emails.

- Transactional Emails: These emails are sent to provide any transaction-related information. It might be any confirmation mail for any transaction being done, etc.

- Welcome Emails: Welcoming emails are automatically sent to a customer if he/she has recently opened a new account in your bank. It usually consists of some helpful information regarding the bank facilities and processing.

- Lifecycle Emails: These emails are automatically sent to their customers with appropriate messages at different stages of their banking life cycle. Like, on anniversaries of the opening of the bank account, after being inactive for a certain period of time.

Thus, email campaigns, irrespective of whether they are automated or personalized, make customers feel that they really matter. In fact, these email campaigns ensure a long-term and better relationship with their clients, which often might lead to considerable returns.

- Mobile Applications (ASO) for Making Banks More Discoverable

Modern consumers nowadays often prefer to connect with their banks via mobile banking apps. This is why mobile apps are also treated as an effective digital marketing strategy that helps increasing awareness about the bank and promoting its services.

- Develop User-Friendly Mobile Banking Apps to Manage Accounts and Transactions

If users don’t find these mobile banking apps easy and simple enough to use, the digital banking tools will lose their value. The banking apps should be made user-friendly so that customers can use all its tools flawlessly.

Even the banking app’s tools should not be made complicated at all. It should be simpler even for an average person to understand and access. Consider these few things while creating user-friendly banking apps:

- Easily Customizable: The bank app should also offer some personalized content and features depending on the banking habits and preferences of the users.

- User-friendly Design: The app’s interface should be clean and intuitive design so that users can easily navigate through it. Its user-friendly design makes it quite simpler for users to get access to any of their banking services and conduct any online transactions.

- Frequent Updates: You should always focus on updating the app with some improvements or added features based on advancements in technology or user feedback. This might also include some security enhancements, the addition of any new features or some performance improvements.

- In App Marketing to Provide More Personalized Deals and Promotions

In app marketing promotes customer engagement with the banks within the app. It also provides them with relevant deals and promotions which attract customers to their bank website. Some marketing strategies include the following:

- Special In-App Offers: Through the app, they can provide their customers some special discounts and offers on banking services and products based on their financial profile.

- Push Notifications: These push notifications on the app can be used to inform its users about some financial tips, exclusive promotions and new features that have been recently introduced.

- Tailored Financial Insights: These in apps offer personalized financial advice and insights to their users depending on their economic behavior and transaction history.

By implementing in app and app store optimization digital marketing tactics, you can ensure to attract new customers seamlessly to your banking services. These tactics involving digital marketing for banks also provide an upper hand to existing customers by keeping them informed about the ongoing discounts and offers from time to time.

- Artificial Intelligence and Chatbots to Enhance Customer Service

In recent times, artificial intelligence and chatbots have revolutionized how customers interact with financial service companies and vice-versa. This has also impacted the banking experience a lot as they are able to provide instant assistance to their customer’s common queries.

- Integration of Chatbots to Offer Quick Responses to Customers

These AI chatbots play a major role in offering quick responses to your customer queries. Here are some easy tasks that these chatbots offer:

- 24*7 Availability: Unlike traditional customer service, AI chatbots never shut down and can be made 24*7 available for answering customer queries. So, instead of outsourcing or hiring any support agents for 24 hours a day, it will be cheaper and more convenient to use AI chatbots.

- Prompt Customer Support: In order to provide support to the customers, these chatbots need not be required to get connected to them. So, this allows instant and quick support to the customers without getting delayed. Chatbots respond immediately.

- Routine Tasks Handled Easily: Some inquiries made by customers are quite simple and require just a few steps. Chatbots can easily automate these tasks and leave the assistants to handle more complex strategies in banking.

- Use Artificial Intelligence to Provide Customers with More Personalized Recommendations

Artificial intelligence is another popular strategy that banks often use to personalize their customer experience. Here is how financial institutions are using AI to enhance their customer’s experience:

- Analyze Data for More Personalization: When the customer’s data are analyzed and shared with AI, they offer more personalized recommendations for their banking products and services. Based on the customer’s app-using behaviour, AI also provides personalized financial advice to them.

- Strengthens Security: AI algorithms analyze the transaction patterns of the customers. In this way, it helps in detecting some fraudulent or unusual activities and flagging them.

- Predictive Analytics: AI has the potential to analyze and predict what might happen in the future based on past experiences. When someone changes their behavior, AI notices that and reaches out to them with products that trigger them at very moment.

Going through FAQ pages can often be time-consuming and frustrating for the users especially if they fail to find the right answers on it. Even talking to customer service agents sometimes does not resolve user’s queries.

Chatbots can significantly improve this customer experience by enhancing their point of contact with the bank.

- Internet Banking to Make Customer Experience Seamless

While conducting digital marketing for banks, you cannot avoid one of its remarkable aspects i.e. internet banking. When online banking is optimized with advanced digital marketing tools, it makes the experience easier, faster, and safer for the users.

- Interface Optimization that Ensures Ease of Use

One of the most important things that really matters for a positive internet banking experience is a user-friendly interface. So, for customer satisfaction and ease of use, banks should keep their focus on the following factors:

- Personalization: The bank’s website should offer various customization options for customer’s ease of use. It might include options like a personalized dashboard that displays only relevant information in a gist or setting up some quick links to banking services that are used frequently.

- Simplified Navigation: The interface of the internet banking website should be designed intuitively for ease in navigation. This makes it easier for customers to find and use some standard banking features like transferring funds, checking balances, paying bills, etc.

- Responsive Design: The banking website should be designed in a way that ensures its responsiveness across all devices. This will offer a seamless experience to users who are accessing your bank website via any device, be it smartphones, desktops or laptops.

- Emphasizing Information Security for Strengthening Trust

For financial products, security is considered the most important. This is the reason why banks should also prioritize these security measures.

- Robust Authentication Processes: Banks should implement some robust authentication methods to enhance the security of online banking transactions. These methods might be two-factor authentication which ensures that online transactions are safe.

- Continuous Updates and Monitoring: Update the security measures on the bank website on a regular basis and monitor the website for potential threats. If the customers are informed about these security features, they will feel safe while doing any online transactions via the banking website. Thus, this will encourage more customers for online banking.

- Data Protection and Encryption: Banks should also make use of advanced encryption technologies for enhancing the protection of sensitive customer data. This will also protect online transactions from any sort of cyber threats.

- Influencer Marketing to Reach Your Target Audience Instantly

There are many youngsters who like to follow the personalities whom they like in their free time. This is why if you want to make your bank seem more relatable, you can easily tap into these influencers.

When you collaborate with these influencers, they help in establishing your trust and credibility with your clients. They also help to build relationships with their clients and position them in a more favorable and authentic way.

Keep in check these strategies while conducting effective influencer marketing in banking:

- Select the Right Influencers: Always attempt to choose those influencers whose followers align with the target audience of the banks.

- Establish Long-term Partnerships: Consider building long-term partnerships with the influencers. This will allow for a more sustained and authentic engagement with their target audience for a longer period.

- Collaborate with Various Influencers: From lifestyle bloggers to financial institution experts, try to collaborate with various influencers. If the bank collaborates with influencers from diverse portfolios, then they will be able to target different segments of the audience effectively.

- Measure the Impact of Influencer Marketing Campaign: The banks should track the performance of their influencer campaigns from time to time. They can do so using analytics and accessing various key metrics like conversion rates, engagement rates, and audience growth.

Thus, this digital marketing strategy can be considered as the newest version of endorsement-based marketing by the celebrity.

4 Reasons to Hire Professional Digital Marketing Agency

As customers are shifting online, they are switching to digital channels instead of traditional marketing channels to seek any products or services. However, banking is one of the business sectors with breakneck competition. Hence, a little help might prove beneficial;

While you can get clients by harbouring digital marketing channels on your own, hiring a professional digital marketing company will render you with a definitive edge.

Let’s take a look at the ways a professional digital marketing agency might contribute towards the growth of banking business;

- Aligns Strategies with Customer Requirements

A digital marketing for the financial sector specialises in studying the customer behaviour pattern on each strata of the conversion funnel. They craft specific digital marketing strategies to align with customers’ requirements. It fosters better professional relations while bolstering business.

- Avail Tailor-Made Strategies

Hiring an expert digital marketing agency comes with the advantage of tailor-made online marketing strategies that suit your business. Banks earn business based on customers’ trust. They have experienced professionals who craft custom-made campaigns specifically for your business. It helps boost your name & fame, which can garner new clients and retain the old ones.

- Cost-Effective

Orchestrating a whole digital marketing campaign by yourself is not only time-consuming but also can prove to be costly. You have to set up paid ad campaigns, take the help of premium tools, and use automation on your own. A digital marketing agency, on the other hand, can assist you in reaching the goal at a relatively lower price point. Some companies even offer a wholesome yet tailored digital marketing package at an affordable price point if you look in the right place.

- Fosters Better Customer Relationships

With effective digital marketing strategies crafted by professionals, you can harbor better customer relations. Expert digital marketing assistance provides easy access to connect with customers using various digital channels, it drives more engagement and more conversions. This is a wise choice as the banking sector largely depends on it. With effective social media marketing, choicest paid ad copies and traction on the organic ranking, you would be able to reach out to target audience and increase your clientele.

The Bottom Line

When it comes to maintaining customer relationships and reaching more customers, the bank’s marketing strategy is everything. The advent of digital marketing for banks has elevated the positioning of banks in the online search, formed some new clientele and fortify bonds with existing clients.

The strategies that are outlined in this blog presents a comprehensive roadmap for the banks to navigate the digital marketing landscape effectively. By implementing these powerful strategies successfully and staying agile, banks should not only survive but also thrive in now and beyond.

So, in a nutshell it can be said that the future of banking is digital, and the time to embark on this transformative journey is now!

Additional Resources:

- SEO for Financial Services: The Ultimate Guide

- SEO for Accountants: The Ultimate Guide to Boost Your Online Presence