In 2023, the global mortgage trading services market was worth $36.5 billion. It is expected to grow at a rate of 7.3% per year from 2024 to 2033 and reach a value of $74.3 billion by 2033. The use of digital platforms and online mortgage agents is going up, which makes things easier for customers and speeds up loan applications. So, in this competitive mortgage industry, if you want to create a strong presence, then you should go for SEO for mortgage brokers. More than 64% of marketing teams around the world think that SEO is their most profitable digital channel.

Yes, there are various marketing options there, like social media marketing, email marketing, and paid ads (Google Ads, Facebook Ads, Instagram Ads, YouTube Ads, LinkedIn Ads, Bing Ads, Twitter/X Ads, Display Ads, and Retargeting Ads). But search engine optimization gives you long-term results and helps your website rank higher in search engine results, ultimately attracting more organic traffic to your site.

In this article, you will learn all the important SEO strategies for mortgage brokers, from starting with competitor market analysis and keyword research to technical SEO and on-page and off-page SEO techniques. So let’s start our journey to improving your website’s search engine rankings and attracting more qualified traffic to your mortgage brokerage business.

What Is SEO For Mortgage Brokers And Why Does It Matter?

SEO, or “search engine optimization,” is the process of making a mortgage broker’s website easier to find for people who are looking for home loans online. A well-optimized website helps a mortgage broker appear high in search engines when a user searches for terms like “best mortgage broker,” “home loan help,” or “best mortgage options.”

Importance Of Mortgage Brokers’ SEO Efforts

- Clients Search for Brokers Online- Most homebuyers start their mortgage research on Google. When your website appears at the top of search results, people trust your business more and contact you for guidance. Globally, 53.1% of all website visits come from organic search, 15.7% come from paid search, and 25.6% come from direct traffic. A prominent SEO places your brand where real demand already exists.

- Free, Consistent Leads Without Paid Ads-SEO doesn’t stop working when the budget runs out, but paid ads do. Once your website ranks, it keeps bringing leads every day. This lowers your advertising costs, increases your profit margin, and helps your business grow in the long term.

- High Trust and Strong Brand Image- People trust Google’s top results because they think they are the most accurate. Clients view you as an expert mortgage agent when your website ranks higher. This improves your reputation and helps you get more sales.

- Competitive Advantage- Your competitors already use SEO. When you ignore it, you lose high-intent clients to them. A strong SEO strategy helps you stay ahead in a competitive industry.

11 Proven SEO Strategies For Mortgage Brokers

Now, let’s directly get into the most useful SEO for mortgage brokers. You will be learning the practical steps of doing keyword research and implementing technical SEO like schema markup implementation, mobile optimization, and canonical tags; developing content; and improving local SEO to dominate the local market, and off-page SEO strategies like digital PR and link building; and also how you can take help from social media platforms. Moreover, you will get to know how to monitor SEO performance for mortgage brokers. So let’s take a deep dive into the world of SEO strategies to improve your mortgage website’s search engine rankings.

Strategy 1 — Competitor & Market Analysis for SEO for Mortgage Brokers

Competitor and market analysis help you understand what other mortgage broker websites do to achieve strong search engine rankings. This process gives a clear idea of the current industry landscape. You see how top competitors use search engine optimization, what type of content they publish, how they structure pages, and what makes search engines trust them. This analysis helps you plan a more effective mortgage broker SEO strategy that aligns with your goals.

This step is important because it shows real gaps in your website. You understand why some reputable websites gain higher positions in search engines. You also discover what your potential clients want from a mortgage broker. Furthermore, you can create better content and a more useful website with this information, which attracts more visitors and increases legitimacy.

Steps to Conduct Competitor & Market Analysis

- Identify your top competitors. Search “mortgage broker near me” or similar terms related to SEO for mortgage brokers. Note websites on the first page.

- Check their domain authority to assess their online strength.

- Moreover, you can review their service pages and blog topics. See what type of information they offer.

- Inspect their keywords. Note the keywords that appear often and match your service.

- Study their website structure. Observe titles, meta descriptions, URL patterns, and page layout.

- Check their backlink sources. Look for reputable websites that link to them.

- Compare their content depth with your pages to find improvement areas.

This is your initial process, which will establish a strong foundation for search engine optimization for a mortgage broker and enhance your website’s competitiveness in the mortgage industry.

Strategy 2 – Keyword Research & Intent Mapping

Keyword research is one of the first things you do for your mortgage website. Your potential clients search for specific terms to find your mortgage services; those are your keywords. You need to find those relevant keywords and put your content, headings, and meta title and meta description. But one thing you need to maintain that fo not to do keyword stuffing, as it can lose your content credibility. You should maintain a keyword strategy to develop your website ranking.

Search Intent

Specific Search intent describes what users want to accomplish when they search. Someone who types “what is a mortgage” seeks education. Another person who searches “mortgage broker near me” wants to hire someone immediately. Most mortgage brokers optimize for keywords, but smart ones optimize for intent, then steal traffic from bigger competitors.

Three main intent types matter for mortgage brokers: informational (learning), navigational (finding a specific site), and transactional (ready to buy). Focus your efforts on transactional and local intent keywords because these convert best.

The most useful keyword research tools are-

- Google keyword planner

- Ubbersujjest

- Semrush

- Answer The Public

- Ahrefs

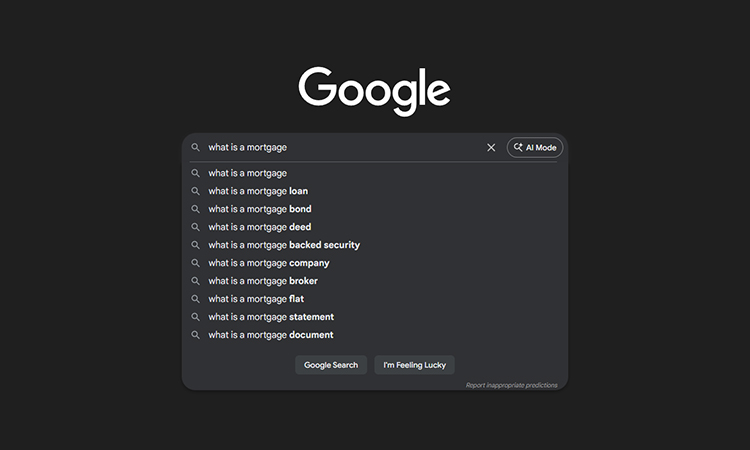

First, you can use Google serach, add your main keyword to Google serach –

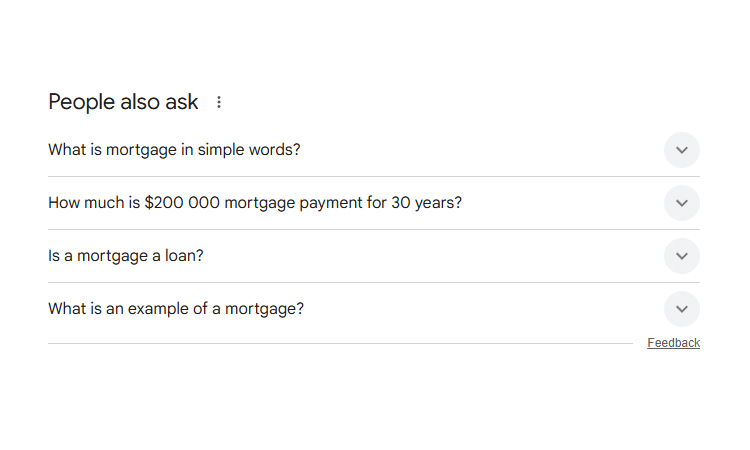

Then check the people Also Ask section to know more ideas regarding your topic-

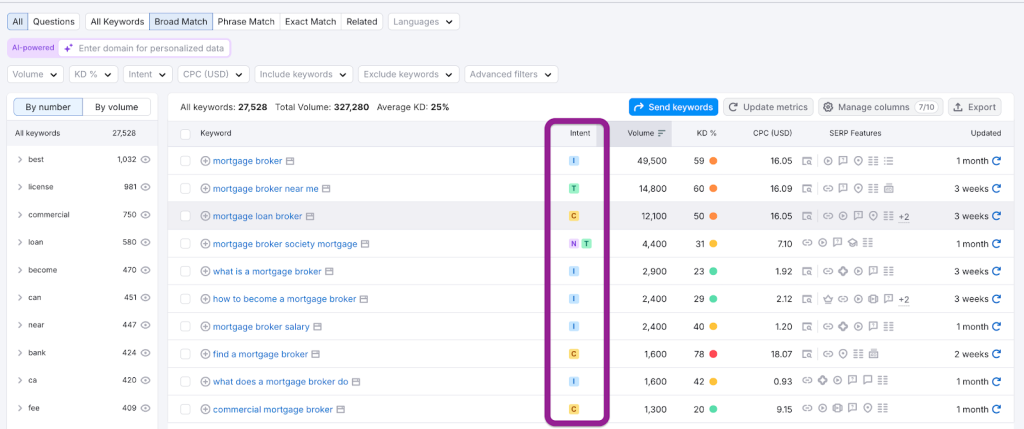

Put main keywords in the search bar, and see the full details-

| Term | Definition | How to Choose (Tips) |

| Keyword Difficulty (KD) | KD shows how hard it is to rank for a keyword in search results. A high KD means strong competition from established websites. | Choose low or medium KD keywords when your site is new. Choose high KD only when you have strong authority. Pick KD that matches realistic ranking goals. |

| Search Volume | Search volume shows how many people type that keyword into search engines each month. High volume means high interest. | Choose keywords with a balance of volume and intent. Do not chase only high volume. Use medium-volume keywords for faster ranking and targeted traffic. |

| CPC (Cost Per Click) | CPC shows how much advertisers pay when someone clicks on an ad for that keyword. High CPC means the keyword has strong commercial value. | Choose keywords with higher CPC for high-value leads. Use low CPC keywords for informational content. Mix both to build a strong keyword strategy. |

SERP analysis means you study the Search Engine Results Page to understand what types of pages currently rank for a keyword. You look at the top 10 results and note what search engines prefer — page format, content depth, user intent, authority level, and keyword placement. This analysis helps you see what Google wants so you can create a page that can actually compete.

Top 10 Best Keywords for Mortgage Websites

These high-value keywords help mortgage websites rank on the first page:

- mortgage broker near me – Highest local intent

- best mortgage rates [city] – Price comparison searches

- FHA loan requirements – Specific loan product research

- First-time homebuyer mortgage – Target audience keyword

- mortgage refinance calculator – Tool-based searches

- VA loan [city] – Geographic loan product

- How to get pre-approved for a mortgage – Process-oriented search

- mortgage broker [city name] – Direct local service

- home loan rates today – Current information search

- mortgage pre-approval [state] – State-specific qualification

Strategy 3 – Technical Audit for SEO for Mortgage Brokers

Technical seo strategies for the mortgage brokers are one of the most important parts of SEO efforts. Without technical audits, how can you? Technical SEO strategies for the mortgage brokers are one of the most important parts of SEO efforts. Without technical audits, how can you ensure that your website is optimized for search engines and provides the best user experience possible? Technical SEO helps identify and fix issues that may be impeding your website’s performance and appearance in search results. So in this segment, you will learn how you maintain site speed with Core Web Vitals and make mobile-optimized web design to help smartphone users, and how you inform search engines which page is real with Canonical Tags and implement perfect schema markup and Robots.txt, and improve your overall website performance.

- Site Speed and Core Web Vitals Improvement

Site speed affects how users experience your website, and Core Web Vitals measure three key aspects: loading speed, responsiveness, and visual stability. Visitors will stay on your mortgage brokerage website longer and submit loan applications if it loads quickly.

A delay of just 100 milliseconds in page speed can reduce conversion rates by 7 percent. This means if your site takes an extra second to load, you lose potential clients who need mortgage services. The three primary Core Web Vitals are LCP (Largest Contentful Paint), FID (First Input Delay), and CLS (Cumulative Layout Shift). You can learn how actual users interact with your website from these statistics.

- Largest Contentful Paint (LCP) calculates how long it takes for the primary content to show up on your screen. Google claims anything under 2.5 seconds is OK, but people want quicker results nowadays. Your homepage hero image or mortgage calculator should appear quickly.

- Interaction to Next Paint (INP) checks how fast your site responds when someone clicks a button or fills a form. The desired INP score should be 200 milliseconds or less. This matters when clients want to apply for loans or use your mortgage calculator tools.

- Cumulative Layout Shift (CLS) measures unexpected movements on your page. An ideal CLS score is less than 0.1. When buttons or text jump around while loading, users get frustrated and leave.

Steps to Improve Your Site Speed

Step 1: Run a Speed Test—First, you can use Google PageSpeed Insights to check your current speed. Type your website address into the tool. You will see scores for mobile and desktop performance. These scores show you exactly what needs work.

Step 2: Compress Your Images—Large images slow down your mortgage brokerage website. So you need to take help from tools like TinyPNG or ImageOptim to make image files smaller. Before you upload any photos of your team, office, or marketing materials, make sure they are small-sized but not compromising the quality.

Step 3: Enable Browser Caching—Browser caching stores some parts of your website on users’ computers. It’s easier for people to get to your site again because their browser already has some files on it. Therefore, you need to get your web developer to set up your site’s cache accordingly.

Step 4: Minimize Code Files—Your website uses CSS and JavaScript files. These files can contain extra spaces and comments that slow down loading. There are useful tools like UglifyJS and CSSNano that remove unnecessary code and make files smaller.

Step 5: Use a Content Delivery Network (CDN)—A CDN stores copies of your site on servers around the world. When someone visits your mortgage brokerage website, they get files from the nearest server. This makes pages load faster for all visitors. Popular CDN services include Cloudflare and Amazon CloudFront.

Step 6: Optimize Database Queries—Your website database stores all content and client information. You should regularly get rid of old data and make database tables work better. In case you have a WordPress site, use plugins like WP-Optimize.

- Mobile Optimization Is Very Important

Over 60 percent of people search any services or products on their mobile devices. When your potential clients search for “mortgage broker near me” or “best home loan rates,” they use phones. So, your mortgage brokerage website must work perfectly on mobile devices to pop up on user search queries.

Google uses mobile-first indexing, which means your mobile site IS your site in Google’s eyes. Search engines check your mobile version first when deciding rankings. A poor mobile site hurts your online visibility even if your desktop site looks great.

How to Check Mobile Responsiveness?

Step 1: Test on Real Devices– First, you can open your mortgage website on actual phones and tablets. Try different brands like iPhone, Samsung, and Google Pixel. Moreover, you need to see all pages load properly and buttons work correctly.

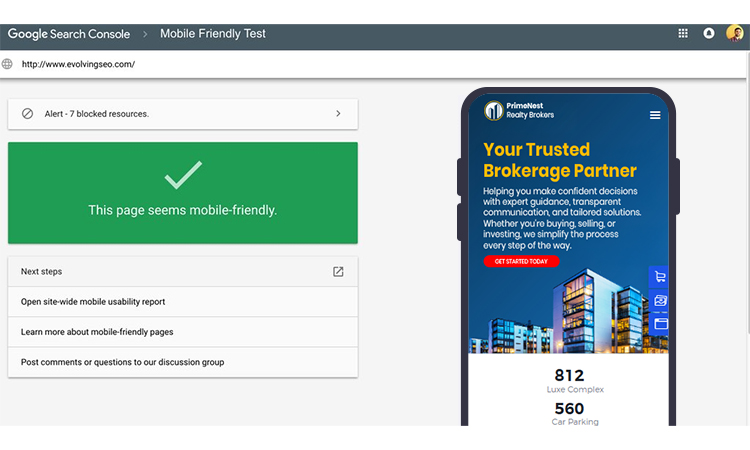

Step 2: Use Google Mobile-Friendly Test– Then visit Google’s Mobile-Friendly Test tool. Enter your website address. Google shows exactly what mobile users see and lists any problems.

Step 3: Check All Interactive Elements– Test your mortgage calculator tools on mobile. Fill out contact forms using a phone keyboard. Make sure dropdown menus work with touch controls. Verify that phone numbers become clickable links.

Step 4: Review Text Readability– The Text should be at least 16 pixels in size on mobile screens. Your target audience should read your mortgage process guides without zooming in.

Step 5: Verify Navigation Menu– Your navigation menu should collapse into a hamburger icon on mobile. When tapped, the menu should slide open smoothly. All links must remain accessible and easy to tap.

Step 6: Test Page Load Speed on Mobile– Most importantly, you can aim for 50 or fewer network requests on mobile. Mobile networks are slower than desktop connections. Every extra script or image increases load time on phones.

- SSL and Security Setup

SSL (Secure Sockets Layer) is a security certificate that encrypts data between your website and visitors. When someone fills out a loan application on your site, SSL protects their personal information from hackers. This protection is essential for mortgage lenders who handle sensitive financial data.

Google announced that HTTPS (secure pages) is one of the signals for page experience. Search engines favor secure websites in rankings. Without SSL, your site shows “Not Secure” warnings that scare away qualified leads. One security breach can destroy your reputation and violate financial regulations. SSL certificates show visitors that you take their privacy seriously.

Steps to Install an SSL Certificate

Step 1: Choose Your SSL Certificate– Most mortgage brokerage websites need a standard SSL certificate. These cost between $0 -$100 per year. So you should contact your web hosting company to purchase one. Many hosts like Bluehost and SiteGround now include free SSL certificates with hosting plans.

Step 2: Install the Certificate-Your hosting provider usually installs SSL certificates automatically. If not, use your hosting control panel (cPanel) to install it. Look for “SSL/TLS” in the control panel menu.

Step 3: Update All URLs to HTTPS– Then you may change every URL on your site from “http://” to “https://”. And try to update internal links in your content, navigation menus, and footer sections.

Step 4: Set Up 301 Redirects- Moreover, you can develop permanent redirects from HTTP to HTTPS versions of all pages. This ensures visitors always reach the secure version of your site. Add redirect rules in your .htaccess file or use a redirect plugin.

Step 5: Update Google Search Console- Add the HTTPS version of your site as a new property in Google Search Console. This helps search engines understand that your site now uses SSL.

Step 6: Test Your SSL Installation– Use SSL Labs SSL Test to verify your certificate works correctly. The tool checks for configuration problems and security issues.

Tools for SSL Management

- SSL Labs SSL Test grades your SSL setup and finds security weaknesses.

- Why No Padlock explains why SSL might not display correctly on some pages.

- Let’s Encrypt provides free SSL certificates that renew automatically.

- XML Sitemap Creation

An XML sitemap is a file that lists all important pages on your mortgage brokerage website. Search engines can use this map to figure out which pages to crawl and index.

Search engines discover your content faster with a sitemap. Your mortgage lender’s pages, services, and education are better listed. Search engines could miss important pages that could bring in qualified leads if you don’t have a sitemap.

Steps to Create XML Sitemap

- You may use a sitemap generation tool or plugin.

- Include just the sites that you want search engines to index.

- Exclude login pages, thank you pages, and duplicate material.

- Keep the sitemap between 50 MB and 50,000 URLs.

- Save it as “sitemap.xml.”

- Upload it to your website’s root directory.

- Submit a sitemap to Google Search Console.

- Include the sitemap location in your robots.txt file.

- When you add new pages, be sure to update the sitemap.

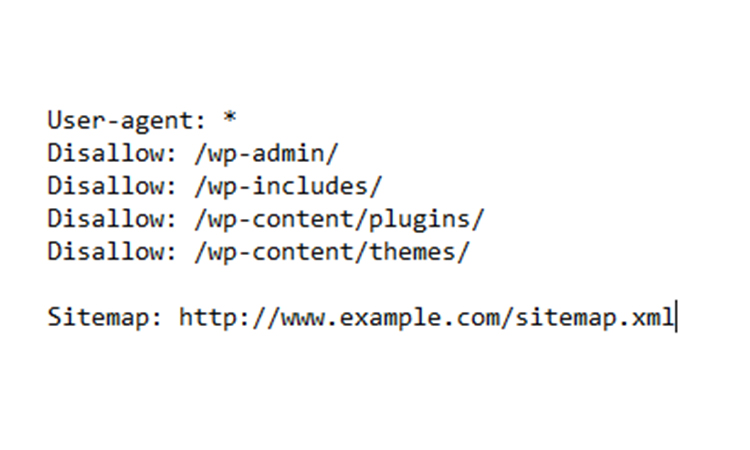

- Robots.txt Optimization

Search engine crawlers can read a robots.txt file to find out which pages on your mortgage agency website they can and cannot reach. This small text file sits in your root directory.

Steps to Optimize

- Develop a robots.txt file in your root directory.

- Allow all important mortgage pages.

- Prohibit admin areas, private pages, and login screens.

- Allow only search results pages and filtered URLs.

- Block duplicate content pages.

- Add your sitemap location at the bottom.

- Test the file using Google Search Console’s robots.txt tester.

- Verify you did not accidentally block important pages.

Basic Robots.txt Structure

- Fixing Crawl Errors

Search engines get crawl errors when they can’t get to pages on your website. Some common errors are 404 pages (not found), 500 errors (server problems), and redirect chains.

Search engines waste time on broken pages instead of indexing your valuable content about mortgage lenders and services. You lose online visibility and frustrate mortgage information consumers with these errors.

Steps to Fix

- Verify the Google Search Console for crawl error reports.

- Identify all 404 errors and broken links.

- Fix or redirect broken pages to relevant content.

- Remove or update broken internal links.

- Contact webmasters to fix broken external links pointing to your site.

- Set up proper 301 redirects for moved pages.

- Fix server errors with your hosting provider.

- Check crawl stats regularly for new errors.

- Structured Data and Schema Markup

Schema markup is code added to your website that translates your content into a language that search engines understand. This code helps search engines understand your mortgage services, loan products, and business information. When search engines understand your content better, they can show rich results in search pages.

Schema markup can offer an additional signal to Google as to who’s doing the talking on webpages, guides, and blogs written for the finance industry. For mortgage lenders, this builds trust and authority in search results. Trust matters greatly when people search for financial services.

Types of Schema for Mortgage Websites

- Organization Schema marks up your business name, logo, address, and contact information. This data creates your Google Knowledge Panel.

- LocalBusiness Schema includes your business hours, service area, and accepted payment methods. This helps local searches find your mortgage services.

- Service Schema describes specific services you offer. You can describe exactly what service is being offered and who is providing it, such as specifying the service type as Mortgages offering Fixed Rate Mortgages.

- MortgageLoan Schema provides details about loan products, including interest rates, loan terms, and payment amounts. This specialized markup is perfect for pages that display different mortgage options.

- FAQ Schema creates expandable question boxes in search results. Use this for common questions about the mortgage process.

- Review Schema displays star ratings in search results. This social proof encourages clicks from potential clients.

Steps to Add Schema Markup

Step 1: Choose Relevant Schema Types– You already know the types of schema, so you need to choose which schema types fit each page. Your homepage needs an Organization schema. Service pages need a Service schema. Loan product pages need MortgageLoan schema.

Step 2: Use Schema Generators– You can use Google’s Structured Data Markup Helper or Schema.org generators. These tools create the code for you. Enter your information, and the tool produces ready-to-use code.

Step 3: Add JSON-LD Code to Pages– The most common format of schema is JSON-LD. Copy the generated code and paste it into your page’s HTML, just before the closing </head> tag. If you use WordPress, paste the code in a plugin like Insert Headers and Footers.

Step 4: Fill in Complete Information– You need to provide as much detail as possible in your schema. Incorporate your business address, phone number, hours, and services. The more complete your schema, the better search engines understand your pages.

Step 5: Test Your Schema– Then you should utilize Google’s Rich Results Test tool. Paste your URL or code snippet into the tool. Google shows what rich results you can get and lists any errors in your markup.

Step 6: Submit to Search Console– After adding schema markup, request indexing in Google Search Console. This helps Google to check your updated pages and recognize the new structured data.

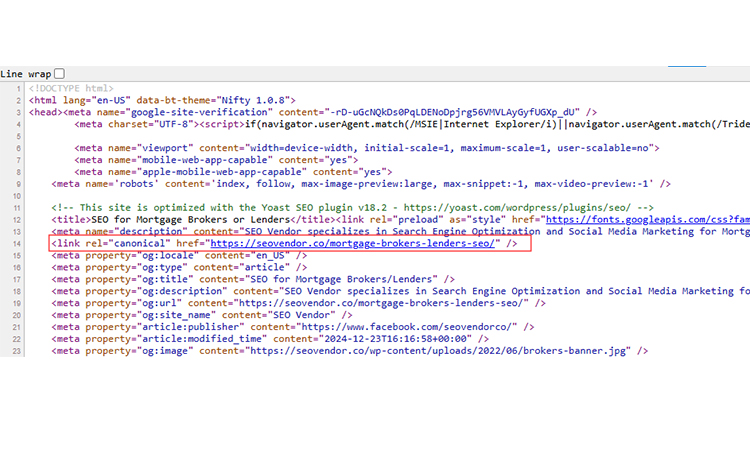

- Canonical Tags

There may be similar pages on your mortgage broker’s website for different loan types or locations. If search engines don’t have canonical tags, they might index the wrong version or give different pages different rankings. If people are looking for a mortgage lender, this will hurt your ranking.

Steps to Implement

- Identify pages with similar or duplicate content.

- Choose the primary version for each set of duplicates.

- Add a canonical tag in the HTML head section.

- Point all duplicate pages to the main version.

- Ensure the canonical URL is the one you want to rank.

- Canonical tags should use absolute website addresses.

- Also, make sure that pages don’t return 404s but 200 status codes.

- Verify that the canonical tags point to indexable pages.

Canonical Tag Format-

Strategy 4 – On-Page SEO Optimization Strategies

The objective of on-page SEO for mortgage brokers is to inform search engines what your website is about, who your ideal customer is, and why your pages should be at the top of search engine results. This part of mortgage broker SEO helps your website speak clearly to both users and search engines. Your pages will be more relevant, clear, and reliable if you stay on track with every part of them. You also give search engines a strong signal that your website is a reputable source for mortgage advice. You’ll learn why each part is important and how to set them correctly in this specific segment.

- Title Tags With Target Keyword

Search engines use title tags to figure out what a page is about. A clear title with the keyword “how to get a first-time homebuyer mortgage” or “what documents do I need for a mortgage” helps search engines understand your subject faster. This is crucial for ranking higher in search results.

Steps to Set Title Tags

- You need to use your main keyword once in the title.

- Keep the length under 60 characters.

- Add a clear value statement such as “Low Rates,” “Expert Advice,” or “Trusted Mortgage Broker.”

- The titles should be different on each page.

- Meta Descriptions and Meta Titles

Meta descriptions support the title and give a short description of what your page offers. A good description increases click-through rates and develops reliability in search engines. The meta title is the main title that appears in search engine results.

Steps to Create Meta Descriptions

- Add your main keyword once, such as SEO for mortgage brokers.

- Keep the description within 155–160 characters.

- The ideal meta title should be within 55-60 characters.

- Use a clear promise and a helpful tone.

- Give users a reason to click, such as “Get expert guidance from a trusted mortgage broker.”

- Header Tags (H1, H2, H3)

Headers help search engines read your page in a structured way. A clear H1 works as your main topic. H2 and H3 tags break the content into logical parts, which helps readers understand your message with ease.

Steps to Structure Headers

- You can insert one H1 per page with the main keyword.

- Then apply H2 tags for major sections.

- Use H3 tags for detailed points under each section.

- Keep every header simple and relevant to the page topic.

- Internal Linking Between Pages

Internal links guide readers from one page to another. This action also helps search engines understand your website structure and authority.

How to Set Up Internal Links

- Link to your most important service pages from blog content.

- Use natural anchor text such as “best mortgage rates in [City].”

- Link from high-traffic pages to new pages for better discovery.

- You should not have long chains of links on the path. Keep it clean and productive.

- FAQ Sections for Voice Search

Every year, voice search gets better. A good Frequently Asked Questions (FAQ) page can help your website rank for natural searches that are related to mortgage lenders.

Steps to Create Voice-Friendly FAQs

- Write questions the same way a user speaks, such as “What does a mortgage broker do?”

- Give short and direct answers.

- Add keywords naturally.

- Add at least 5–7 FAQs on important pages.

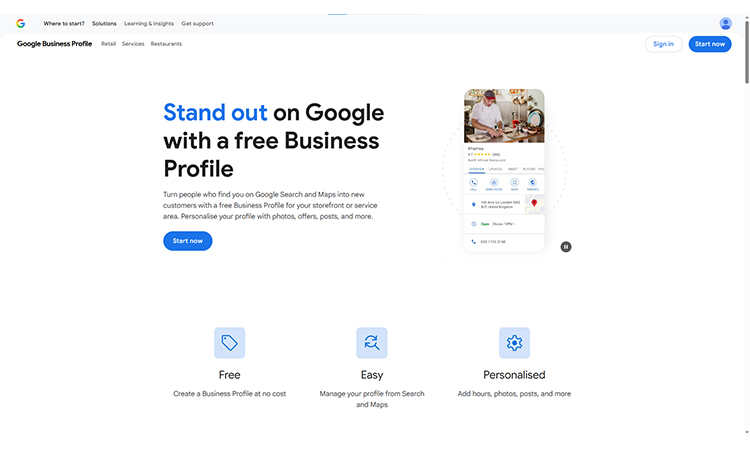

Strategy 5 — Google Business Profile Optimization for SEO for Mortgage Brokers

Local SEO (search engine optimization for local search results) is all about getting people in your area who are looking for services like yours to find your business. Local SEO doesn’t try to reach people all over the world or across the country. Instead, it focuses on local searches, like “mortgage broker near me” or “mortgage broker in [city].” It helps your business show up in local search results, on maps, and in the “local pack” that search engines often show for queries that are specific to a certain area.

Clients searching locally often have high intent. They may need services quickly: home loans, refinancing, property mortgages, etc. So, being a mortgage broker, it will be beneficial for you to appear in local search results.

A properly maintained Google Business Profile increases authority. Accurate address, business hours, contact number, photos, and reviews help present your mortgage broker business as genuine and professional.

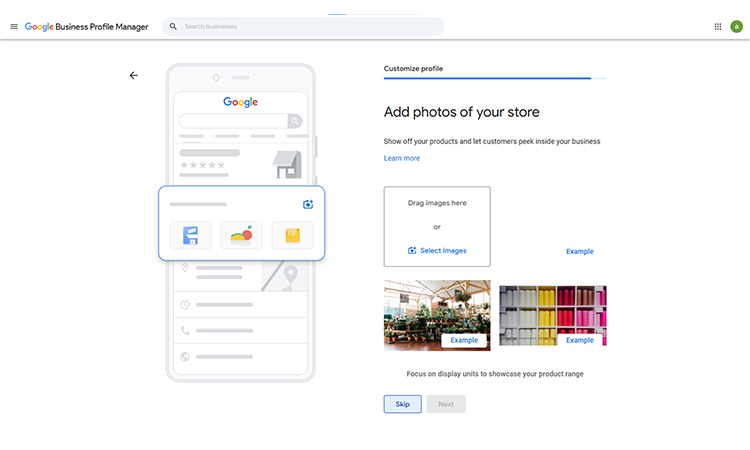

Steps to Set Up and Maintain GBP for Mortgage Broker SEO Strategies

GBP serves as your business’s digital listing on search engines and maps. For a mortgage broker, GBP acts like a digital office address. Many local businesses do not fully optimise or verify GBP; a well-maintained profile gives you an extra advantage in terms of acquiring local qualified traffic.

First, you need to open- https://business.google.com/en-all/business-profile/

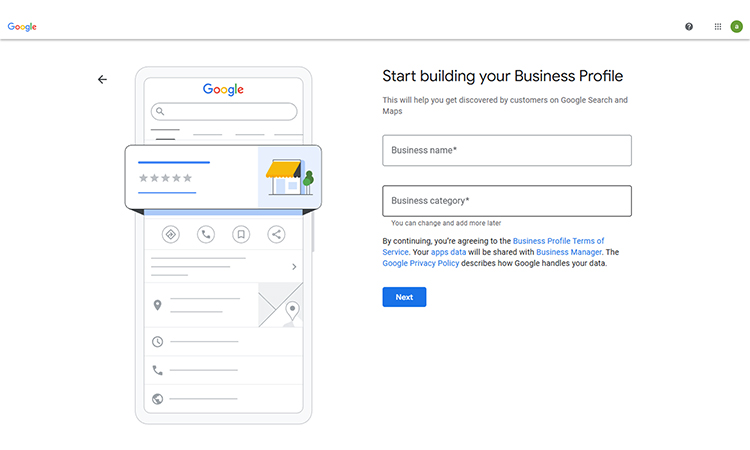

Then you need to sign up with your business email ID.

Add your business name and choose your category.

Then, if you want to add your office location, click on “YES” so that your clients can come and visit.

Add your contact information carefully. Try to give the same contact that is all over your online platforms, like your website and social sites.

Then select your services carefully.

Then mention your opening hours when your clients can communicate with you.

Write a compelling description of your business.

You can take AI’s help to develop your business description. So you may use this prompt to generate a business description for your mortgage business. Moreover, you can use local keywords like “mortgage broker near (area name)”, “home loan services in [city],” etc. This will improve your local search rankings.

Add photos of your office, staff (optional), and relevant imagery. These photos build trust and click-through rates.

Moreover, you need to update posts or announcements to show how Google Business Profile is active and relevant, which increases local search ranking to attract potential clients.

Furthermore, you can Google Business Profile dashboard to check how many people call you, click for directions, or visit the website. Adjust details or service area if needed.

Strategy 6 — NAP Consistency & Local Citations in Mortgage Brokers SEO

- NAP consistency means your name, address, and phone number stay the same across every online platform. When the same information appears everywhere, search engines will have more trust in your mortgage broker business. You need to maintain complete control over each local listing because even minor errors can negatively impact local visibility. This will help you to dominate your local market and attract more local clients.

- You gain strong results when you target directories made for mortgage brokers. Try to utilize platforms like Zillow, LendingTree, Bankrate, Mortgage Daily, Yelp, and local chamber-of-commerce sites to help you develop a reputation. These local directories act as reputable sources that confirm your business identity. When your details match on all of them, your local search performance grows faster.

- You get better results when you add your listing to general directories as well. Google Business Profile, Bing Places, Apple Maps, Foursquare, JustDial, and IndiaMart boost trust and help clients reach you faster.

Strategy 7 — Blog Content Planning & Topic Clusters for Mortgage Brokers SEO

Your mortgage business needs more than random blog posts to rank well. An effective SEO strategy starts with organized content that helps search engines understand your expertise. Topic clusters group related content around core services to address this issue.

- What are Topic Clusters?

Topic clusters organize your content like a hub-and-spoke system. Your main service pages act as pillar content (the hub), while individual blog posts (the spokes) explore specific subtopics. Each spoke links back to the pillar, and the pillar links out to all related spokes. This structure shows search engines you cover topics thoroughly, not superficially.

For example, a “First-Time Homebuyer Mortgages” pillar page connects to blog posts about down payment options, credit score requirements, FHA loans, and pre-approval steps. Each post reinforces the pillar’s authority on that subject.

- Build Your First Topic Cluster

You need to begin with your most profitable service. Most mortgage brokers should begin with one of these pillar topics:

- First-time homebuyer programs

- Refinance options

- Investment property loans

- VA loans

- FHA loan programs

Choose one pillar and create 8-12 blog posts that support it. Each blog post should answer one specific question your clients ask.

For a first-time homebuyer pillar, create posts like:

- How much down payment do first-time buyers need

- Credit score requirements for first-time buyers

- First-time buyer grants in [Your City]

- Pre-approval vs pre-qualification explained

- How to save for a down payment

- Common first-time buyer mistakes to avoid

- Best home loan types for first-time buyers

- First-time buyer closing costs breakdown

- E-E-A-T Content Optimization

Google evaluates mortgage content through E-E-A-T: Experience, Expertise, Authority, and Trustworthiness. Your content must prove you know the mortgage process better than competitors.

- Experience Signals

Your content should demonstrate real-world experience. Share actual scenarios you have handled. Write about neighborhood-specific loan success stories. For example: “We helped five families secure FHA loans in the Riverside district last quarter when rates dropped to 6.2%.”

Publish neighborhood case studies that show your hands-on experience in specific areas. This local focus helps you appear in searches from real estate investors and homebuyers in those areas.

- Expertise Elements

Display your credentials prominently. Every author bio should include:

- Licensing information and NMLS number

- Years in the real estate industry

- Specializations (VA loans, jumbo mortgages, etc.)

- Relevant certifications

Use clear, jargon-free language. Expertise means you can explain complex topics simply, not that you use complicated terms.

- Authority Builders

Build authority by earning backlinks from reputable websites and collaborating with industry influencers. When real estate agents link to your content, search engines notice.

Create resources worth linking to:

- Comprehensive mortgage calculators

- Local market rate comparisons

- Detailed loan comparison charts

- City-specific homebuyer guides

Partner with real estate agents to co-create content. A joint article about your local market builds authority for both parties.

- Trustworthiness Markers

Display customer testimonials, ensure clear contact information, and regularly update content to reflect current industry standards. Trust matters more in the real estate industry than almost any other sector.

Add these trust elements to every page:

- Physical office address

- Direct phone number

- Client reviews with full names (with permission)

- BBB rating or accreditation

- Professional association memberships

- Clear privacy policy

- Secure contact forms

You can encourage satisfied clients to leave detailed reviews. A five-star rating with “John helped us close in 21 days despite credit challenges” beats a generic “great service” review.

- Content Calendar Structure

Successful mortgage brokers plan their content three months in advance. Moreover, you can create a simple spreadsheet with the following columns: publish date, topic, target keyword, cluster category, and status.

Alternate between these content types:

- Educational guides (50%)

- Local market updates (20%)

- Loan product explanations (20%)

- Client success stories (10%)

Educational content answers common questions. Market updates show you stay current. Product explanations help qualified leads understand options. Success stories build emotional connection.

- Write for Humans, Optimize for Engines

Your effective SEO strategy fails if the content reads like robot-generated text. Write naturally, then optimize. Add target keywords to:

- Page title (front-load the keyword)

- First paragraph

- One H2 heading

- Image alt text

- URL slug

Do not force keywords where they do not fit. Search engines reward helpful content that keeps readers on the page, not keyword-stuffed articles that make people leave.

- Certifications and Credentials

Your NMLS number should appear on every page. Professional certifications from industry associations build immediate credibility. BBB ratings and accreditations tell visitors you meet high standards.

- Topic Ideas That Attract Qualified Leads

Focus your content on high-intent topics. Someone searching “how to get pre-approved for a mortgage in [City]” shows more purchase intent than someone reading “what is a mortgage.”

High-conversion topics include:

- How long does mortgage approval take in [State]

- Documents needed for a mortgage application

- How to improve your credit score for a mortgage

- Best mortgage rates in [City] for [Month]

- VA loan requirements in [State]

- Investment property loan down payments

- Refinance savings calculator

- First-time buyer programs in [County]

These topics attract people ready to act, not just browse.

- Award Recognition

Furthermore, Industry awards or local business honors deserve prominent placement. Media mentions from news outlets add third-party validation. Partnership logos from reputable lenders strengthen your professional image.

Strategy 8 — Digital PR & High-Authority Link Building for SEO for Mortgage Brokers

Your mortgage brokerage needs more than just a website to compete online. High-quality link building from trusted sources gives a signal to search engines that your business deserves top rankings. This guide shows you exactly how digital PR and strategic link-building can transform your online visibility and bring qualified traffic to your door.

- Digital PR Means Helps Mortgage Brokers

Digital PR combines traditional public relations with online strategies to earn media coverage and high-quality backlinks. For mortgage brokers, this means your business gets featured on news sites, industry publications, and trusted local platforms.

- You share clear advice on loan trends, interest rates, or first-time buyer challenges. Journalists prefer mortgage brokers who speak with clarity, so your chances for features rise. You also look for platforms like Housing.com, MoneyControl, Economic Times, and real-estate blogs that often cover mortgage topics.

- Strong Digital PR also comes from data reports. You can publish a small study on local loan demands or property affordability.

- High-Authority Link-Building Techniques

Search engines rank websites based partly on their backlink profile. Your competitors with stronger link profiles will outrank you, even if your content is better. High-quality backlinks act as votes of confidence from other websites.

Local backlinks prove especially valuable for mortgage brokers. A link from your city’s chamber of commerce, local business association, or regional news site signals to Google that you serve that specific area. These local signals help you appear in “mortgage broker near me” searches.

- Industry Association Links- Your membership in mortgage industry associations provides natural link opportunities. Organizations like the National Association of Mortgage Brokers list members on their websites. Chamber of commerce directories, better business bureau profiles, and professional networking groups all provide legitimate local backlinks. These listings also improve your local listings’ consistency across the web.

- Educational Content Outreach-You can create comprehensive guides, calculators, or research reports that naturally attract links. A detailed first-time homebuyer guide for your city becomes a resource that other websites want to reference. Local real estate agents, financial advisors, and community websites will link to truly helpful content.

- Guest Articles on Industry Sites-Moreover, established real estate and finance websites need quality content. You can offer to write detailed articles that educate their readers about mortgage topics. These guest posts typically include an author bio with a link back to your website. Target publications your target audience actually reads. Local real estate blogs, regional business journals, and state-specific homebuyer resources all make sense.

- Broken Link Replacement- Websites frequently link to resources that no longer exist. You can find these broken links on relevant sites, then offer your content as a replacement. This technique works because you help webmasters fix problems while earning a quality backlink.

- Best Tools to Optimize Link Building- You can take help from Tools like Ahrefs or Screaming Frog to find broken links on websites in your industry. You then create or identify existing content on your site that serves as a perfect replacement. Your outreach email simply points out the broken link and suggests your resource as a solution.

You can use Semrush Backlink Analytics to analyse backlinks like this-

- Local Link-Building Partnerships in Mortgage Brokers SEO Strategies

Local link-building gives your mortgage broker business a strong edge in local search. Search engines trust you more when respected local platforms mention your name. You gain authority, online visibility, and direct referral traffic from people who need mortgage support in your area.

- Local real estate agents, property lawyers, builders, architects, and home-inspection companies often look for trusted mortgage experts. You can create simple resource pages together or share each other’s website links.

- Local newspapers, finance bloggers, housing forums, and community websites also offer strong link opportunities. You can share insights, mortgage tips, or market trends. These platforms hold relevance and bring real local traffic.

- You can offer to write mortgage content for agent websites. An article about “How to Get Pre-Approved in [Your City]” posted on a real estate agent’s blog with your byline and link helps both businesses. The agent gets valuable content for their readers, and you get a relevant local backlink.

- Don’t forget about Local sponsorships; it will give you exceptional exposure. So, small events, housing fairs, financial workshops, or charity events often list sponsors on their websites. One quality link from a respected local source often beats multiple weak links.

Strategy 9 — Reputation Management & Reviews To Improve Mortgage Business Online

Your mortgage business success relies heavily on what people say about you online. Positive reviews directly influence potential clients who search for mortgage services. Over 98% of homebuyers read online reviews before they choose a lender, which makes reputation management essential for your growth.

- Best Tips for Reputation Management

- Request Reviews Immediately After Closing-The best time to ask for reviews happens right after you close a loan. Your satisfied clients feel most enthusiastic about your service at this moment. Send a personalized request within 24 hours of closing, when the positive experience remains fresh in their minds.

- Make the Review Process Simple-Clients avoid complicated review processes. Send them a direct link to your Google Business Profile or preferred review platform. Remove every obstacle between their willingness to review and the actual submission. A one-click process generates far more reviews than multi-step requests.

- Respond to Every Review-You should reply to both positive and negative reviews. Thank satisfied clients for their feedback and address any concerns from unhappy customers publicly. Your responses show future clients that you value feedback and take customer service seriously.

- Monitor Multiple Review Platforms-Your reputation exists across major search engines and online platforms- Google, Facebook, Zillow, and industry-specific sites. You cannot manage what you do not monitor. Check all platforms regularly and respond promptly to maintain consistent engagement.

- Use Automation Strategically-Automated review requests save time and ensure consistency. Set up triggers that send review requests when loans close. However, personalize these messages with client names and specific loan details to maintain authenticity.

- Best Tools for Reputation Management

- Birdeye-This platform helps mortgage businesses generate reviews across 200+ sites and integrates with over 3,000 systems. The automated review requests through text or email make the process seamless for your clients. The AI-powered response generator helps you reply quickly to all feedback.

- Experience.com– This tool specializes in mortgage professionals and automatically sends review requests when loans close. The platform connects multiple review sites to one dashboard and helps boost your Google rankings through strategic review collection.

- Podium-This comprehensive platform manages customer reviews, handles text communications, and processes payments all in one place. The text marketing features help you stay connected with clients throughout the mortgage process.

- Reputation.com- This enterprise solution tracks reviews across hundreds of sources and provides AI-driven insights about customer sentiment. The competitive analysis feature shows how your reviews compare to other mortgage lenders in your area.

- ReviewTrackers-This tool consolidates reviews from multiple channels into one actionable stream. The platform simplifies review monitoring and helps you respond quickly across all platforms from a single dashboard.

Your reputation management strategy should focus on consistency. Regular review collection, prompt responses, and continuous monitoring create a strong online presence that attracts more clients to your mortgage services.

Strategy 10 — Social Media platforms help the mortgage industry

Social media transforms how mortgage professionals connect with potential clients. These platforms help brokers share valuable content, answer questions, and interact with their potential clients.

- Facebook remains the most popular platform for mortgage brokers. You can create business pages, share market updates, and run targeted ads to reach first-time homebuyers in your local area.

- LinkedIn works best for professional connections. Mortgage brokers use this platform to network with real estate agents, financial advisors, and other industry professionals who provide referrals.

- Instagram attracts younger homebuyers through visual content. You can post home photos, success stories, and educational tips that engage millennials and Gen Z buyers.

- YouTube helps you explain complex mortgage topics through video content. Tutorials about loan types, approval processes, and market trends establish your expertise and attract qualified leads.

Strategy 11 — Monthly SEO Tracking & Reporting for Mortgage Brokers

Your mortgage business needs consistent SEO measurement to understand what works and what requires adjustment. Monthly tracking reveals patterns in your search performance and helps you make smart decisions about where to focus your efforts.

- What SEO Tracking Means

SEO tracking monitors how your website performs in search engines over time. You measure keyword positions, traffic sources, user behavior, and conversion rates. This data shows whether your SEO efforts deliver results or need changes. Without regular tracking, you operate blind and waste resources on strategies that do not work.

- Key Metrics to Track on a Monthly Basis

- Keyword Rankings-Your position in search results directly affects traffic. Track your top 20-30 keywords every month. Focus on terms like “mortgage broker [city],” “FHA loans,” and “first-time homebuyer mortgage.” Monitor both improvements and declines. When rankings drop, investigate why and fix problems quickly.

- Organic Traffic Volume-The number of visitors from major search engines shows your overall visibility. Track total sessions, new users, and returning visitors. Compare each month to the previous period and the same month last year. Seasonal patterns affect mortgage searches, so year-over-year comparisons provide better context.

- Conversion Rates-Traffic means nothing without conversions. Track how many visitors submit contact forms, call your office, or use mortgage calculators. Calculate the percentage of organic visitors who become leads. Your goal is to improve this rate consistently, not just increase traffic.

- Page Performance-Some pages attract more qualified leads than others. Identify your top 10 pages by traffic and conversions. See which topics resonate with your audience. Double down on content types that work. Replace or improve pages that get traffic but no conversions.

- Backlink Profile-New backlinks boost your authority. Track how many new links you earn each month, which domains link to you, and your overall domain authority score. Watch for toxic links that could harm your rankings. Remove or disavow bad links promptly.

- Essential Tracking Tools

- Google Analytics 4

- Google Search Console

- Rank Tracker Tools

- Google Business Profile Insights

- What A/B Testing Means

A/B testing compares two versions of a webpage element to see which performs better. Version A serves half of your visitors while version B serves the other half. You measure which version generates more conversions. The winner becomes your new standard, and you test another element.

For mortgage brokers, conversions mean form submissions, phone calls, calculator uses, or application starts. Even small improvements compound over time to dramatically increase lead volume.

- Critical Elements to Test

- Call-to-Action Buttons-Your button text and design significantly impact click rates. Test phrases like “Get Pre-Approved” against “Check My Rate” or “Start Application.” Try different colors that contrast with your page background. Orange, green, and red often outperform blue or gray. Test button sizes and placement. Larger buttons typically perform better, but the test confirms this for your audience.

- Form Length and Design-Long forms intimidate visitors and reduce completions. Test a full application form against a simple two-field lead capture. Try multi-step forms that break the process into smaller chunks. Progressive forms feel less overwhelming and often improve completion rates by 80% or more.

Test which fields are truly necessary. Do you need both phone and email initially? Can you collect additional information after the initial contact? Every field you remove typically increases completion rates.

- Headlines and Value Propositions-Your headline determines whether visitors stay or leave. Test specific benefit statements against generic ones. “Close Your Loan in 15 Days” likely outperforms “Mortgage Services.” Test questions that engage readers: “Ready to Buy Your First Home?” versus “Expert Mortgage Guidance.”

Include your unique selling point prominently. Test messages about your speed, rates, or customer service. See which resonates most with your target audience.

- Trust Signals and Social Proof-Customer testimonials, security badges, and credentials all build trust. Test their placement and prominence. Try testimonials near your form versus at the page bottom. Test star ratings or full review text. Experiment with video testimonials against written ones.

Test different types of credentials. Does your NMLS number, years of experience, or total loans closed resonate more? Place your strongest trust signal prominently and test alternatives.

- Page Layout and Structure-The arrangement of elements affects how visitors move through your page. Test important information above the fold versus further down. Try single-column layouts against two-column designs. Experiment with image placement and size.

Test the order of content sections. Should testimonials appear before or after your service description? Where should your calculator sit on the page? These decisions significantly impact conversion behavior.

- How to Run Effective Tests?

Step 1: Form a Clear Hypothesis

Do not test randomly. You can start with data about where visitors leave your site or which pages convert poorly. Then you may create a specific prediction: “Adding customer photos to testimonials will increase form submissions by 20% because it makes reviews feel more authentic.”

Step 2: Choose One Element

Test only one change at a time. If you modify both your headline and button color simultaneously, you will not know which caused any improvement. Focus on the element most likely to impact conversions.

Step 3: Determine Sample Size

You need enough visitors for statistically significant results. Small websites might require several weeks to gather sufficient data. Most tests need at least 100 conversions per variation before concluding. Calculate the required sample size before you start.

Step 4: Run Tests Properly

Split traffic evenly between versions. 50% see version A, 50% see version B. Run tests for at least two weeks to account for day-of-week variations. Include weekends in your test period, as behavior often differs.

Do not stop tests early just because you see a leader. Random fluctuations can make one version appear better temporarily. Wait for statistical significance, typically 95% confidence level.

Step 5: Analyze Results

Look beyond just conversion rate. Check if the winning version attracted lower-quality leads or changed your cost per acquisition. Sometimes higher conversion rates come with lower lead quality. Balance quantity with quality.

Document everything. Record what you tested, your hypothesis, results, and insights. This knowledge compounds over time and informs future tests.

- Best Tools for A/B Testing

- Google Optimize-This free tool integrates perfectly with Google Analytics. Create visual experiments without code for simple tests. Track goals automatically from your Analytics setup. The visual editor lets you modify headlines, buttons, and images easily. Best for beginners and small businesses.

- VWO (Visual Website Optimizer)-This platform offers robust testing features with excellent support. Create multivariate tests that examine multiple elements simultaneously. Use heatmaps to see where visitors click and scroll.

- Optimizely-This enterprise solution provides advanced testing capabilities and detailed segmentation. Target specific visitor groups with different experiences.

- Unbounce-This landing page builder includes built-in A/B testing. Create custom mortgage landing pages without developers. The drag-and-drop editor simplifies changes. Dynamic text replacement personalizes pages for different ad groups.

Final Words Before We Conclude

A strong SEO strategy gives mortgage brokers a steady flow of qualified leads, higher trust, and long-term visibility without depending on expensive ads. When your website ranks for the right keywords, homebuyers and refinancing clients find you at the exact moment they need guidance. This creates better conversions and a stronger brand presence. Remember, SEO is a continuous process that requires monitoring and adjusting strategies based on performance data and industry trends. Though you can handle your SEO campaigns on your own, if you take a professional digital marketing company’s help, then they will guide you more professionally and help you achieve better results in a shorter amount of time. Their expertise and resources can provide important suggestions and strategies to optimize your SEO efforts and increase your online visibility. If you want consistent enquiries and a stronger local authority, SEO is not just useful—it is essential for building a sustainable and successful mortgage broking business.